Journal Description

Ekonomi Islam is a journal of the Islamic Banking study program, Faculty of Islamic Studies, Universitas Muhammadiyah Prof DR HAMKA (E-ISSN: 2527-7081, P-ISSN: 2087-7056). The Ekonomi Islam is a national peer-reviewed journal. This is a semi-annual journal, published twice a year (May and November). Ekonomi Islam has been acknowledged by the Republic of Indonesia's Ministry of Research, Technology, and Higher Education since 2020 with grade 4 (Sinta 4) accreditation.

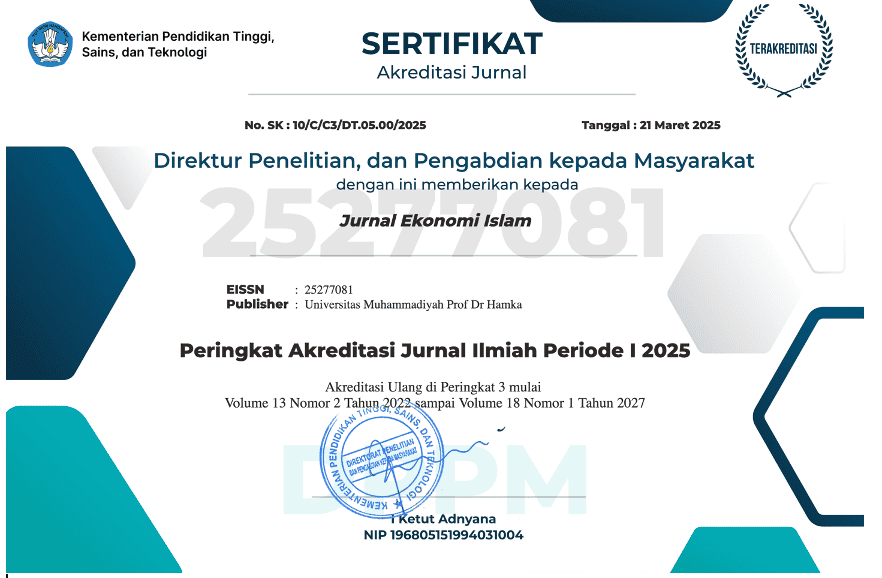

In 2025, Alhamdulillah, this journal has received Sinta 3 accreditation based on the Minutes of Determination of Journal Accreditation Results for Period I of 2025, a Decree of the Director General of Higher Education, Research and Technology Number 10/C/C3/DT/05/00/2025 dated March 21, 2025 concerning Scientific Journal Accreditation Rating for Period I of 2025.

The Ekonomi Islam focuses on a broad range of topics covering all categories of Islamic Economics, Islamic Banking, Islamic Capital Market, Management from Islamic Perspective, Islamic Business Ethics, Principles, and Practices of Sharia Law (including policy) that are of regional and global relevance. The Ekonomi Islam’s scope is the journal endeavors to publish high quality research that makes a contribution to the literature and/or has an impact on policy making. In this regard, the Ekonomi Islam welcomes research papers from Islamic banking, Islamic Insurance and Islamic Capital Market practitioners, Crowdfunding, Islamic Fintech, academics, and policy makers regardless of their institutional affiliation and geographic location.

The full manuscript should be sent electronically using the online submission form. Complete and original research manuscripts that are not currently under consideration by another publication are invited to be submitted to JEI.

| Online ISSN | : | 2527-7081 |

| Print ISSN | : | 2087-7056 |

Current Issue

Vol. 16 No. 2 (2025): Jurnal Ekonomi Islam Fakultas Agama Islam UHAMKA

Authors' Countries: INDONESIA, AMERIKA SERIKAT, TAIWAN, JERMAN, MALAYSIA, JEPANG

EKONOMI ISLAM is a journal focused on Islamic Economics, Islamic Banking, Islamic Capital Market, Management from an Islamic Perspective, Islamic Business Ethics, and the Principles and Practices of Sharia Law. The journal is open and welcomes contributions from various disciplines and research approaches, including quantitative, qualitative, and mixed methods. This edition has been available online since November 30, 2025. All articles in this volume (12 original research articles) were written by 46 authors from 24 affiliations across 5 countries (Indonesia, Amerika Serikat, Taiwan, Jerman, Malaysia, Jepang). The affiliations are as follows:

- Politeknik Perikanan Negeri Tual, Maluku Tenggara, Indonesia

- STEI Hamfara Yogyakarta, Indonesia

- Universitas Airlangga, Surabaya, Indonesia

- Universitas Islam Indonesia, Yogyakarta, Indonesia

- Universitas Islam Negeri Imam Bonjol, Padang, Indonesia

- Universitas Islam Negeri Sultan Syarif Kasim, Pekanbaru, Riau, Indonesia

- Universitas Islam Negeri Sumatera Utara, Medan, Indonesia

- Universitas Mataram, NTB, Indonesia

- Universitas Muhammadiyah Prof. DR HAMKA, Jakarta, Indonesia

- Universitas Muhammadiyah Surabaya, Jawa Timur, Indonesia

- Universitas Paramadina, Jakarta, Indonesia

- Universitas Pembangunan Nasional Veteran Jakarta, Indonesia

- Universitas Pendidikan Nasional, Indonesia

- Universitas Siliwangi, Tasikmalaya, Indonesia

- Arizona State University, Tempe, United States

- Asia University, Taichung, Taiwan

- Institute for Future Energy Consumer Needs and Behavior (FCN), Germany

- International Islamic University Malaysia, Kuala Lumpur, Selangor, Malaysia.

- Kyoto University, Japan

- Malaysian Institute of Industrial Technology, Johor Bahru, Johor, Malaysia

- RWTH Aachen University, Germany

- Universitas Kebangsaan Malaysia

- Universitas Teknologi Malaysia

- Universiti Kuala Lumpur, Malaysia

All articles have undergone the review, revision, and editorial process in the EKONOMI ISLAM journal until reaching the publication stage.

Published: November 30, 2025